- Government bond yields broadly rose in May, as investors demanded higher premiums for longer-dated debt.

- In the US, the government’s ‘One Big Beautiful Bill’ legislation raised concerns about the country’s ability to service its growing fiscal deficit.

- Both investment-grade and high-yield credit spreads tightened during the month.

May was another volatile month in bond markets, as trade tensions, inflationary pressures and fiscal policy concerns put upward pressure on yields.

In the US, the 30-year Treasury yield broke above 5.0% after the government’s ‘One Big Beautiful Bill’ legislation narrowly passed through the House of Representatives before heading to the Senate for a final vote. The bill, which includes sweeping tax cuts that would likely add to the country’s growing fiscal deficit, put upward pressure on Treasury yields. A weaker-than-expected auction of 30-year Treasuries further fuelled fiscal spending worries.

European government bond markets also came under pressure, with Germany’s 10-year bund yield rising to 2.51% and peripheral euro area bond markets experiencing volatility amid fiscal, inflationary and global trade concerns. Despite these challenges, expectations of further rate cuts by the European Central Bank (ECB) and positive fundamental factors provided some support, as European government bonds proved more resilient than their US Treasury counterparts.

As sovereign bond markets navigated a complex landscape, credit markets were more positive, with investment-grade (IG) and high-yield (HY) credit spreads retracing most of the widening they had experienced the previous month. The rebound was boosted by a tariff de-escalation between the US and China. The reprieve helped boost corporate bond markets, with US and European credit returns ending the month in positive terrain.

In the US, headline and core inflation (which excludes volatile food and energy prices) remained stable at 2.3% and 2.8%, respectively. In the UK, headline inflation jumped to 3.5%—its highest level in 15 months—while core inflation rose to 3.8%. In the euro area, headline and core inflation fell to 1.9% and 2.3%, respectively. Ratings agency Moody’s downgraded its US sovereign credit rating by one notch, from Aaa to Aa1, citing concerns over increases in fiscal deficits, although the reaction in bond markets was short-lived. The US dollar continued to decline, having fallen 7% since the start of 2025.

At the May central bank meetings, both the ECB and the Bank of England cut interest rates by 25 basis points (bps), referencing the expected impact of tariffs on economic growth. The US Federal Reserve left rates unchanged.

Monthly performance by market

| Global government bonds | Corporate bonds | Emerging market bonds | |||

| UK | Europe | US | HY | ||

| Bloomberg Global Aggregate Treasuries (USD Hedged) | Bloomberg Sterling Corporate Bond Index (USD Hedged) | Bloomberg Euro-Aggregate Corporates Index (USD Hedged) | Bloomberg Global Aggregate USD Corporate (USD Hedged) | Bloomberg Global High Yield Index (USD Hedged) | JP Morgan Emerging Markets Bond Index EMBI Global Diversified (USD Hedged) |

| -0.54% | -0.12% | 0.72% | 0.01% | 1.68% | 1.12% |

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Source: Bloomberg, for the period 30 April 2025 to 31 May 2025. Bloomberg indices are used as proxies for each exposure1.

Government bonds

Developed market government bond yields broadly rose in May, with investors demanding higher premiums for US assets. In the US, two-year yields rose by 30 bps, while 10-year yields rose by 24 bps. In Europe, German two- and 10-year bund yields rose by 9 bps and 6 bps, respectively. In the UK, two- and 10-year gilt yields rose by 22 bps and 21 bps, respectively2.

Credit

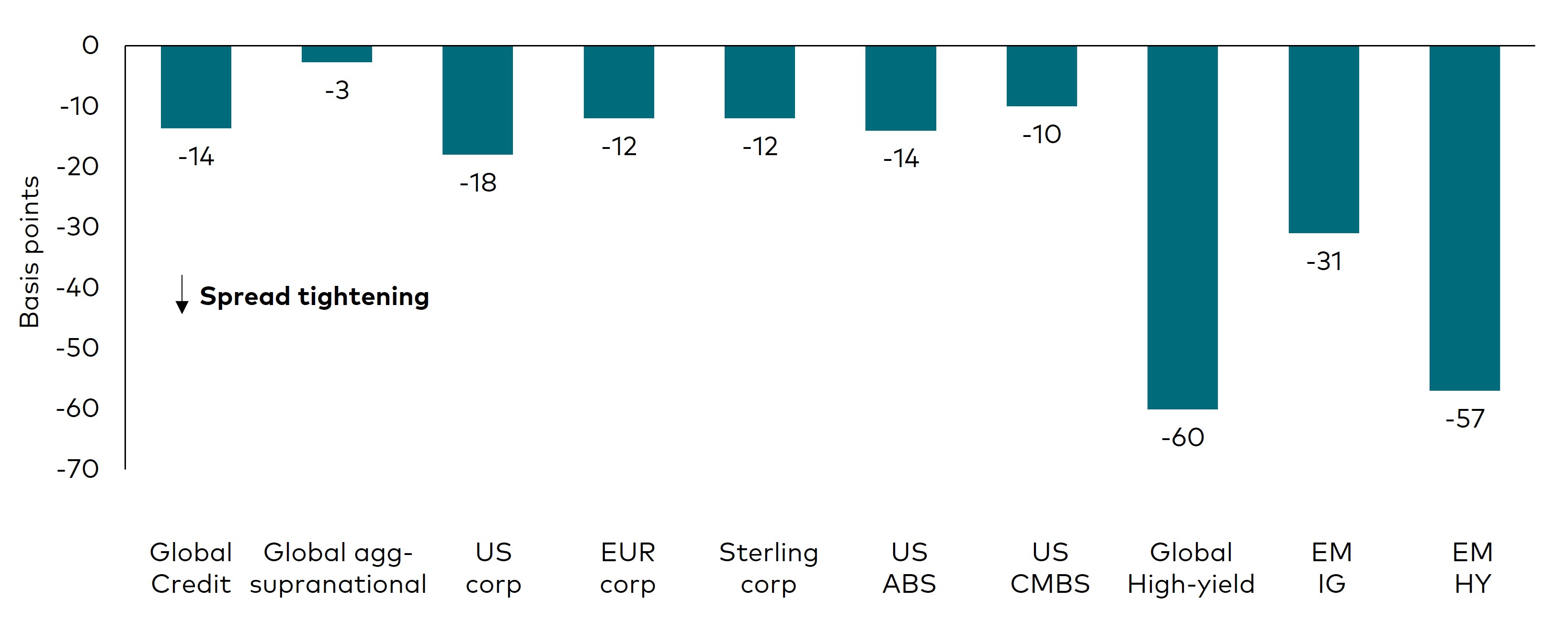

In global credit markets, IG spreads broadly tightened over the month, as markets retraced April’s move wider. US dollar-, euro- and sterling-denominated IG credit spreads tightened by 18 bps, 12 bps and 12 bps, respectively3. HY credit spreads tightened contracted significantly, declining 60 bps during the month. Emerging market (EM) spreads also compressed, with EM IG and EM HY spreads tightening 31 bps and 57 bps, respectively4.

Changes in spreads

Source: Bloomberg. For the period 30 April 2025 to 31 May 2025. Proxies used for each exposure5.

Despite tariff concerns setting a gloomy tone heading into the Q1 corporate earnings season, the results delivered a moderate positive surprise (+6.4%). 60% of STOXX600 companies beat expectations. Financials, materials, healthcare and utilities sectors led the ‘beats’. On average, corporate earnings were 2.4% higher than in 2024 (and up 8% after excluding the energy sector).

European IG company fundamentals are still in good shape, with most companies well-positioned to handle any tariff-related adjustments. Profit margins over the past few quarters have held up well compared with long-term historical levels, while net leverage has been broadly stable.

Over the coming months, European credit should benefit from investors reaching for high-quality sources of yield. We believe accommodative rate cuts by the ECB and a jump in negative-yielding ‘safe haven’ assets like Swiss government bonds will help boost growth and drive investors into European IG. Issuance exceeded €100 billion in May, with year-to-date issuance of around €400 billion breaking records and running ahead of last year. We expect new supply to be quieter in the second half of the year, with net new issuance for 2025 expected to be flat or slightly lower compared with 2024.

Emerging markets

EM credit participated in May’s bond rally, returning 1.1% for the month. EM credit spreads compressed 34 bps, absorbing the back-up in US Treasuries and regaining their historically tight starting valuations coming into the year6. EM HY outperformed, returning 2.3%, while EM IG gains were offset by US Treasury losses, finishing flat for the month7. Romania (+2.4%) and South Africa (+3.4%) were among the top EM performers in May8.

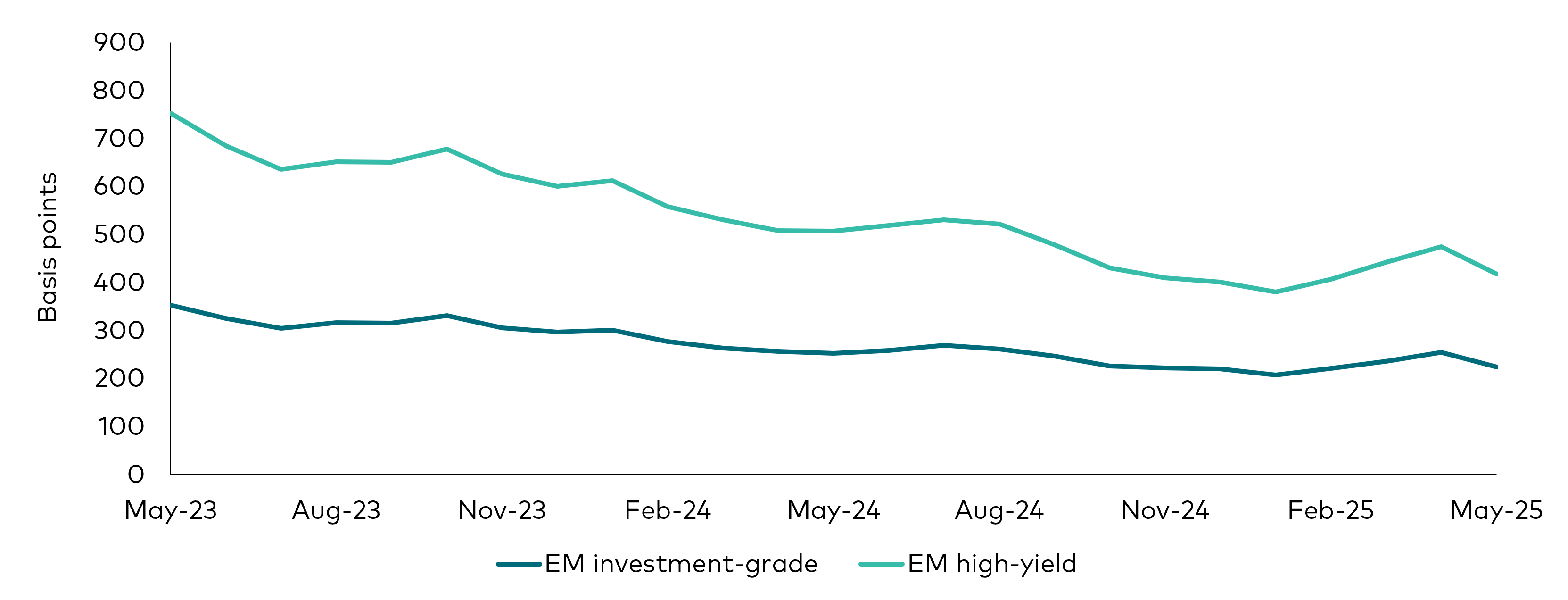

EM credit yields

Source: Bloomberg and Vanguard. For the 24 months through 30 April 2025. Proxies used: EM IG: Bloomberg EM USD Aggregate Average OAS Index; EM HY: Bloomberg Emerging Markets High Yield Average OAS Index.

Outlook

Despite the volatility, bond yields remain attractive. We expect fixed income to continue delivering strong positive returns across most market environments, with spreads continuing to retrace back down towards their historical lows.

Global credit still offers a higher yield than cash and would likely outperform if further rate cuts were to be priced in. While credit spreads have tightened, some valuations appear stretched. Nevertheless, we see opportunities in selective IG issuers, particularly in Europe, where fundamentals remain robust and valuations still look relatively attractive compared with the US IG market. Tighter HY credit valuations warrant caution, especially as a recessionary outcome would leave lower-quality sectors more exposed.

Similarly, EM credit spreads back near their recent tights, valuations look less compelling. We are taking a more selective approach, focusing on value opportunities within and across EM markets.

1 Source: Bloomberg and Vanguard, based on the Bloomberg Global Aggregate Credit Index, for the period 30 April 2025 to 31 May 2025.

2 Source: Bloomberg and Vanguard, for the period 30 April 2025 to 31 May 2025.

3 Source: Bloomberg and Vanguard, based on the Bloomberg Global Aggregate Credit Index, for the period 30 April 2025 to 31 May 2025.

4 Source: Bloomberg and Vanguard, based on the Bloomberg EM USD Aggregate Average OAS Index and Bloomberg Emerging Markets High Yield Average OAS Index, for the period 30 April 2025 to 31 May 2025.

5 Source: Bloomberg indices: Global Aggregate Credit Average OAS Index, Global Aggregate Supranational Index, US Aggregate Corporate Average OAS Index, Euro Aggregate Corporate Average OAS Index, Sterling Aggregate Corporate Average OAS Index, US Aggregate ABS Average OAS Index, US Aggregate CMBS Average OAS Index, Global High Yield Average OAS Index, JP Morgan EMBI Global Diversified IG Sovereign Spread Index, JP Morgan EMBI Global Diversified HY Sovereign Spread Index. Data for the period 30 April 2025 to 31 May 2025.

6 Source: Vanguard and JP Morgan, based on the JP Morgan Emerging Market Bond Index (EMBI) Global Diversified, for the period 31 March 2025 to 30 April 2025.

7 Source: Vanguard and JP Morgan, based on the JP Morgan Emerging Market Bond Index (EMBI) Global Diversified relative to US Treasuries, for the period 31 March 2025 to 30 April 2025..

8 Source: Bloomberg and Vanguard, based on the Bloomberg Emerging Markets USD Aggregate Average Option Adjusted Spread (OAS) Index and Bloomberg Emerging Markets High Yield Average OAS Index, for the period 31 March 2025 to 30 April 2025.

I nostri fondi obbligazionari attivi gestiti internamente

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results. The performance data does not take account of the commissions and costs incurred in the issue and redemption of shares.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Group (Ireland) Limited. All rights reserved.

© 2025 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2025 Vanguard Asset Management, Limited. All rights reserved.